Welcome to Part 3 of this

series looking at the ways in which the

book industry is in a state of flux as part of the move to digital formats and

services. I’m not using terms such as ‘crisis’ to describe the situation because I believe that across the various industries examined in this blog

we’re looking at redistributions – of value, power, and access -- and rather than

characterize such changes as evil/apocalyptic or godsend/cybertopian I’m more

interested in considering new ways of being that are made possible via new

technologies, new systems, and new relationships between creator and audience.

Welcome to Part 3 of this

series looking at the ways in which the

book industry is in a state of flux as part of the move to digital formats and

services. I’m not using terms such as ‘crisis’ to describe the situation because I believe that across the various industries examined in this blog

we’re looking at redistributions – of value, power, and access -- and rather than

characterize such changes as evil/apocalyptic or godsend/cybertopian I’m more

interested in considering new ways of being that are made possible via new

technologies, new systems, and new relationships between creator and audience.

I was originally going to include a section on the new intermediaries/middlemen in the book industry in this post, but decided to save that for a few days from now as I didn't want to overload you first with statistics, followed by information about value chains at the industry level. So we'll take this in two parts.

In the first, which is today’s post, we'll take a closer look at more book

industry facts and figures, and then next week we’ll look at some of the

new players emerging in the world of publishing as traditional publishing

houses prove themselves to be adept at dealing with blockbuster titles (on the

odd occasion when they happen) but less effective for the smaller, niche titles

that seemingly come out of nowhere but can still find an audience with the

right mix of interesting material and smart outreach and promotion.

With traditional print revenues dropping double digit percentages in recent years there are some obvious questions that arise at this juncture, such as ‘will this be the music industry all over again’? Will the digitization of the product lead to a significant downsizing of the overall market? The music industry was the first to feel the wet towel slap of digitization, with file sharing technologies, unbundling of the album format, and streaming music services dramatically changing the way the business worked, for both music labels and artists. Today the music industry is worth about half of what it was in 2000 and to varying extents labels and artists have had to retool how they earn revenues.

Will a similar pattern follow in the book publishing industry? Will chapter books become the 'singles' of the book world? Will book-of-the-month style subscriptions such as those offered by Audible.com (owned by Amazon since 2008) take over the roles of retail outlets, and to some extent print publications and radio, as they also offer credits and bundles featuring radio shows, podcasts, and interviews with authors. Will authors increasingly take the DIY route and crowdfund with sites such as Kickstarter, essentially a prepaid way to offer specialty products to avid fans who just want to see the project get done? And what about Netflix-style ‘all you can eat’ plans, such as those offered by Scribd and Kindle Unlimited, where subscribers pay $9.99/month or less for laptop, eReader, tablet, and/or smartphone access to a library of 500,000+ titles, and growing. Will consumers shift from the habit of buying a few specific titles a year to moving to the book buffet? And if so to any or all of these possibilities, what will the effects be on writers, booksellers/retailers, publishers, and, of course, readers?

Will a similar pattern follow in the book publishing industry? Will chapter books become the 'singles' of the book world? Will book-of-the-month style subscriptions such as those offered by Audible.com (owned by Amazon since 2008) take over the roles of retail outlets, and to some extent print publications and radio, as they also offer credits and bundles featuring radio shows, podcasts, and interviews with authors. Will authors increasingly take the DIY route and crowdfund with sites such as Kickstarter, essentially a prepaid way to offer specialty products to avid fans who just want to see the project get done? And what about Netflix-style ‘all you can eat’ plans, such as those offered by Scribd and Kindle Unlimited, where subscribers pay $9.99/month or less for laptop, eReader, tablet, and/or smartphone access to a library of 500,000+ titles, and growing. Will consumers shift from the habit of buying a few specific titles a year to moving to the book buffet? And if so to any or all of these possibilities, what will the effects be on writers, booksellers/retailers, publishers, and, of course, readers?

First, some statistics from

the world of eBook sales:

1. eBooks now account for

approximately 1/3 of all books sold.

2. Amazon has about 65% of the eBook market (with Barnes & Noble and Apple coming in with 25% and 10% for second and third places

respectively). Ed. Note: This market

dominance is one reason why the dispute between Amazon & Hachette has been

so heated.

3. The market for books is

bigger -- and more fragmented -- than ever. To wit, there are now hundreds of thousands

of self-published and/or eBooks released each year – and that number has

grown by over 400% since 2007, the year the Amazon Kindle eReader was introduced. Last year there were close to

400,000 self-published books released, an amount more or less equal to the number released by traditional publishers in the US.

4. About 50% of Americans

have devices optimized for eBook consumption. Less than five years ago that

number was almost zero and you’ll see in the chart below that the penetration

rate of tablets and eReaders has been dramatic. This will likely continue to grow, as will eBook publishing, resulting in eReading becoming a completely mainstreamed practice.

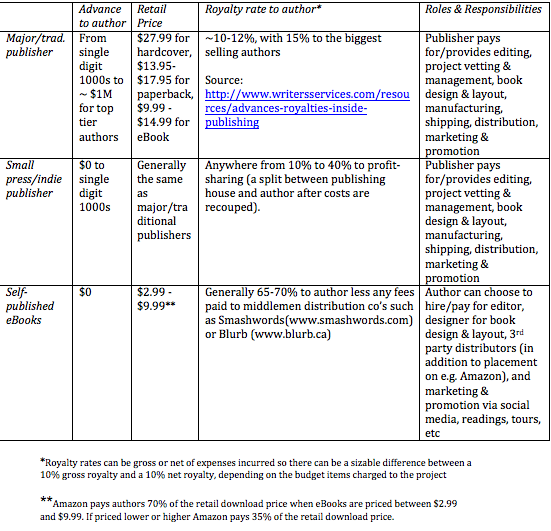

There are a few things to bear in mind with these figures. For example, by the time you get to #1000 on the top 2500 list the actual sales figures are likely to be pretty darn small, and almost certainly not a living wage. As is the case in many industries, a disproportionate amount of the sales are concentrated in the top 1% or so of earnings, with the other 99% distributed across an increasingly large group of creators. We know, e.g. that the top earning author made $95 million last year, and that if we scroll down the list to the 10th best selling author the figure for earnings ‘drops’ to $20 million. Still a large number, yes, but a difference of almost 80% between the earnings of author #1 and author #10. My very strong hunch is that if we were able to peer at the sales figure for, say, the 500th best selling author, the numbers would probably not be very high. Why? Well, as we learned in a previous post on this blog, 90% of books published sell fewer than 100 copies per year.

The eBook market, being digital every click of the way, is also able to provide us with granular data on reading habits, such as these, from the past year of Scribd, one of the eBook subscription services referred to above.

Ed. Note: Among the things we learn: People seem to have great intentions when it comes to improving their mind, body & spirit, and their business acumen, but only seem to follow through with romance.

This collection of numbers and anecdotes provides us with a glimpse of the landscape in which book publishing today needs to be considered. Not as the business it once was, where there were fewer authors handed the keys to the kingdom, where advances were generally in the tens of thousands of dollars and higher, and where physical retail and broadcast media were the holy grail of distribution and marketing. Instead we have a new world with new formats, new commerce platforms, and in which hundreds of thousands can participate. All this can be achieved with a relatively small financial investment, in the case of self-publishing an eBook, or an investment of nothing but time, as is the case with a blog. Excuses for not participating in publishing, in the broadest sense of the term, are limited only by one's efforts. Whether it's a small gesture like a Tumblr account or an Instagram feed -- yes, that's publishing too -- or a larger undertaking like a blog or eBook, it is often about self-expression, accumulating social and cultural capital, and creating links in a value chain, more than it is about trying to bring in dollars. It's a different kind of marketplace, as is now the case in so many of the creative industries, where we see mass production as the dominant way of being shifting to production by the masses.

And with all this in mind, the next post in this series will look at some of the new intermediaries that are forming the links in this value chain, making self-publishing feasible as hobby, small scale cash flow, or full time living for those able to figure out how to turn crisis into new opportunities.

Related Post: How the self-published 50 Shades of Grey accomplished in 2 years what took others decades

And with all this in mind, the next post in this series will look at some of the new intermediaries that are forming the links in this value chain, making self-publishing feasible as hobby, small scale cash flow, or full time living for those able to figure out how to turn crisis into new opportunities.

Related Post: How the self-published 50 Shades of Grey accomplished in 2 years what took others decades